why is pfizer stock so cheap

Therefore you might want to consider some of the key factors that could influence the stocks performance in the. It is cheap changing hands at a priceearnings ratio of just 144 at a time.

Analysts recommendations show a 12-month targeted price.

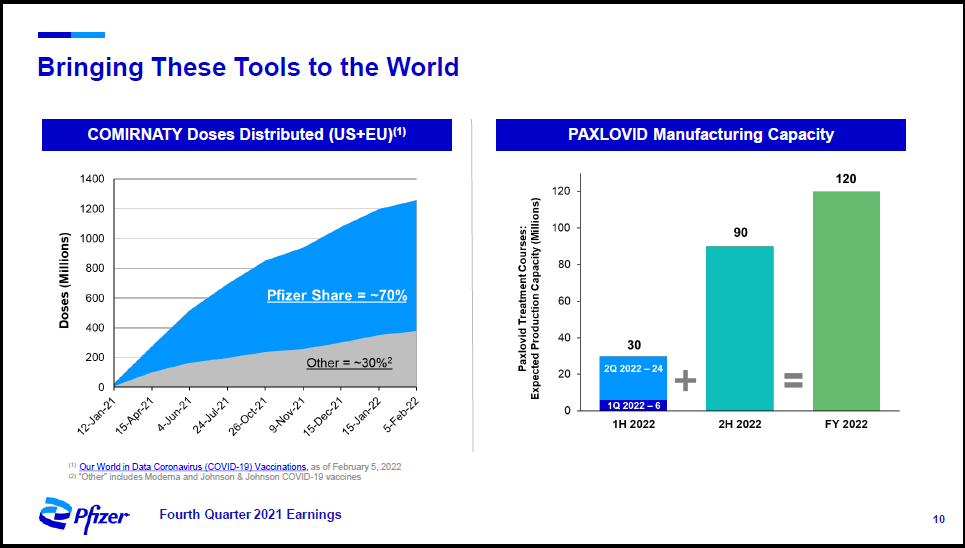

. Pfizer Stock Is Cheap Relative to Its Peers. Pfizer is a much bigger company with numerous meds on the market and others in the pipeline. The first two cheap stocks discussed here are pharmaceutical companies.

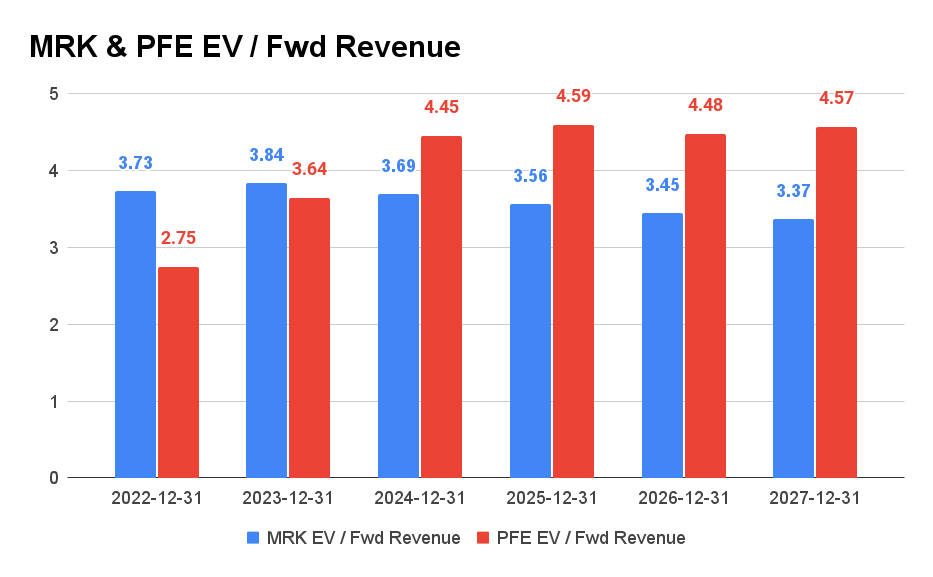

The question however is why Pfizer stock seems so cheap. Trading at a forward price-to-earnings of around 125 times Pfizer trades in deep value territory. Why Is Pfizer Stock So Low.

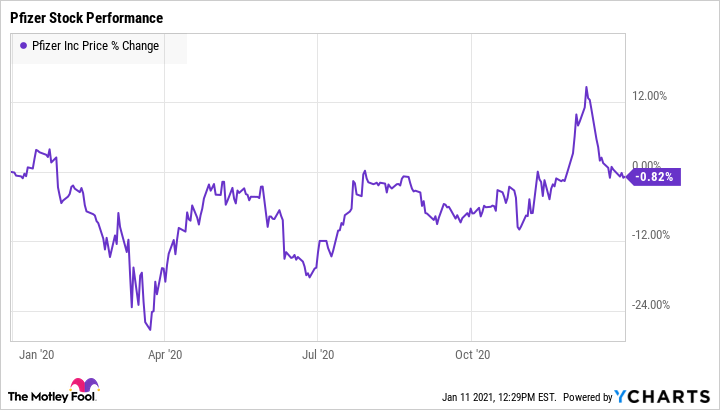

The Pfizer stock has improved by nearly 44 in the last 12 months and the analysts estimate the stock has a potential to return 120. A perfect storm has battered the New York-based drug makers fortunes of late with rising concerns surrounding President Joe Bidens Medicare cost cutting plans uncertainty over the need for Pfizers Covid. Pfizer is a Dog of the Dow and pays a high dividend.

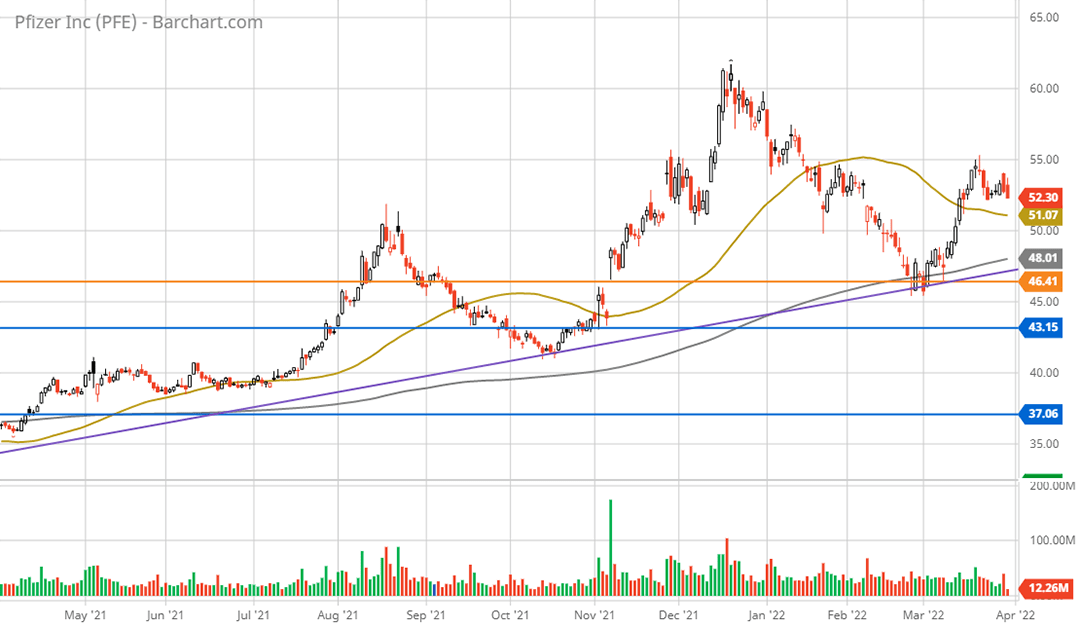

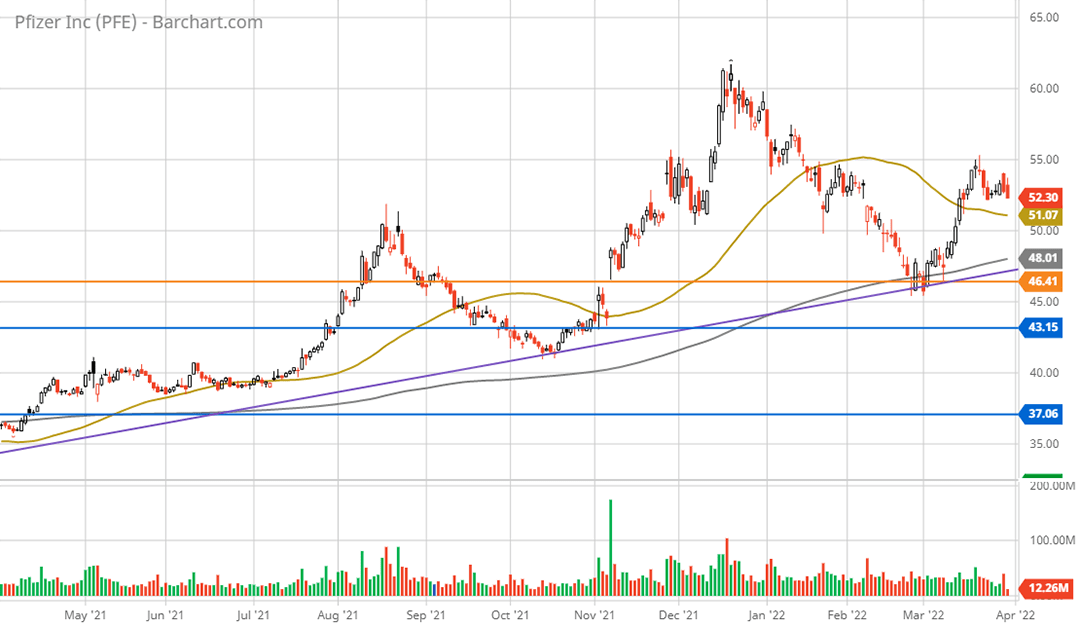

Shares in the American pharmaceutical corporation Pfizer PFE are currently trading 17 down from their all-time August closing highs of 5042. Whats Next For Pfizer Stock. Implied Volatility on Pfizer shares in the 3rd percentile is at the same level as it was before the Covid-19 vaccine.

Volatility spikes driven by news arent priced in. That puts it looking pretty cheap right. Why Pfizer Stock Didnt Soar After Its Fantastic Q1 Results.

Answer 1 of 5. But the stock may still not be cheap enough. For example PFE trades at a forward price-earnings ratio of.

So a few reasons why their pe is so low. Earnings Strong In the fourth quarter adjusted Pfizer earnings were 108 per share on 2384 billion in sales. Though the revenues declined 35 from 53.

By headhe fundamentalists selling out and lowering it during massive market booms it makes private investors think it sucks and they sell their positions. 1 day agoAnalysts expect that Pfizer will report earnings of 723 per share in the current year and earnings of 569 per share in the next year so the stock is trading at 9 forward PE. Pfizer Stock Drops After Q4 2021 Report.

PFE is now cheaper than its drug stock peers. Analysts believed that Pfizer would report earnings of 673 per share in 2022 so the companys guidance of. Its a yield company as in their revenue is no longer growing so you are looking at it from a yield perspective and in this environment that means dividend as earnings is fairly volatile.

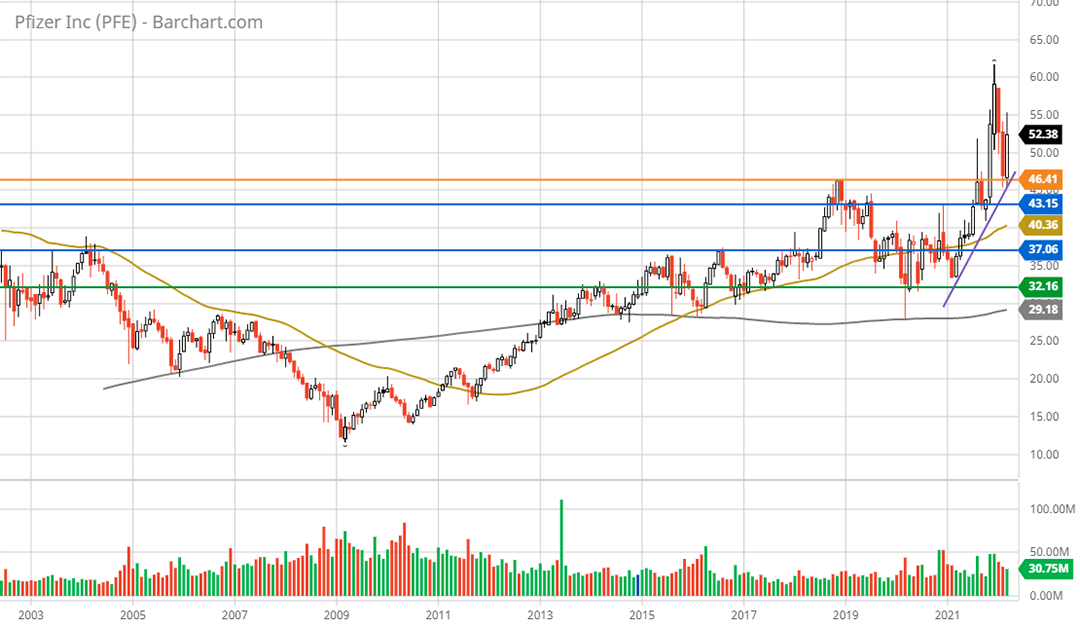

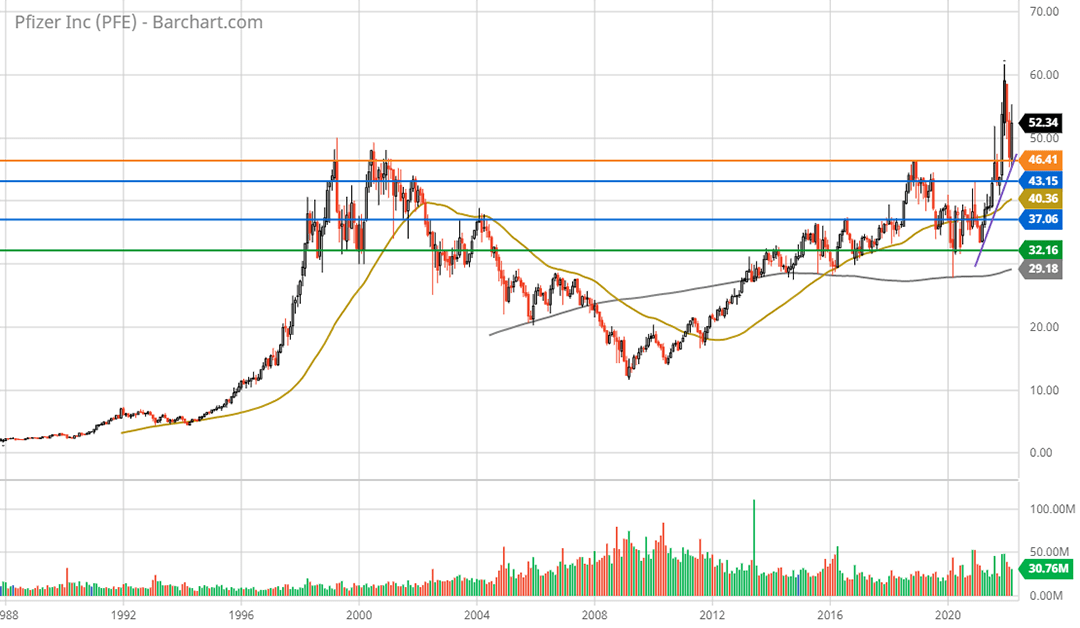

You might have noticed a pattern. The stock spent much of the last half-decade since 2016 in the 30 to 35 range. 8 hours agoPfizer is expected to post earnings of 173 per share for the current quarter representing a year-over-year change of 86.

They do have quite a few programs in clinical trials and a total of 20 developmental candidates. Thats a lot better than where Pfizer stock was in March but 2020 so far is yet another dismal year. In 2019 Pfizers shares fell 10 while the SP 500 index soared nearly 29.

So is the third. Its actually 11 from what I see on yahoo. Moderna has no med that has been approved for distribution yet.

So when it finally does pop there is more money to be made by big firms. Those concerns have been around for a while now a key. Because it will be the one that creates the REAL vaccine.

Pfizer PFE 173 too is a drugmaker with an inexpensive. Pfizer is a Public Limited Company incorporated under the Indian Companies Act 1913 having its registered office in Mumbai Maharashtra and is listed on the BSE Limited and the National Stock Exchange of India Limited Pfizer Ltd. Over the last 30 days the Zacks Consensus Estimate has changed -19.

So all in all is PFE stock a buy. Shares of Pfizer gained downside momentum after the company released its fourth-quarter earnings reportThe company reported revenue of 2384 billion and adjusted earnings of 108 per share missing the analyst estimates on revenue and beating them on earnings. One reason to buy Pfizer stock is its lush dividend yield of 425 more than double that of the SP 500.

And the answer seems to be based on very real concerns about the Pfizer business. So the 8 looks even better. Some of the stock price rise over the last year or so is justified by the roughly 54 growth seen in Pfizers EPS from 190 in 2018 to 292 in 2019.

Pfizer Pfe How It Could Double Seeking Alpha

Pfizer Stock Price And Chart Nyse Pfe Tradingview

Pfizer Vs Merck Stock Battle Between Giants During Pandemic Seeking Alpha

:max_bytes(150000):strip_icc()/3-3a4c5d6eab9c47f9a0cca1daa0f78c42.jpg)

Pfizer Positioned For Future Upside

120 Million Reasons To Buy Pfizer Stock On The Dip The Motley Fool

Everything You Need To Know About Pfizer Stock Story The Cents Of Money

Pfizer Pfe How It Could Double Seeking Alpha

2 Green Flags For Pfizer S Future The Motley Fool

Companies That Rode Pandemic Boom Get A Reality Check The New York Times

Pfizer Stock Is Pfe Stock A Buy After Spending 525 Million To Bolster Rsv Efforts Investor S Business Daily

Pfizer Pfe Stock Price News Info The Motley Fool

How To Buy Pfizer Pfe Stock Forbes Advisor

Pfizer Pfe How It Could Double Seeking Alpha

Should You Really Invest In Pfizer Stock In 2021 The Motley Fool

Pfizer Stock Price And Chart Nyse Pfe Tradingview

Pfizer Pfe How It Could Double Seeking Alpha

Pfizer Vs Merck Stock Battle Between Giants During Pandemic Seeking Alpha

Does The Current Dip In Pfizer Stock Offer A Buying Opportunity

Pfizer Stock History How The Drugmaker Became An Industry Giant The Motley Fool